will capital gains tax rate increase in 2021

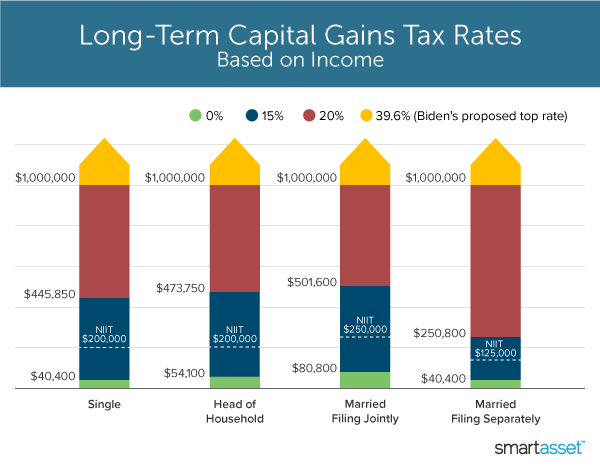

Web As previously mentioned different tax rates apply to short-term and long-term gains. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

What S In Biden S Capital Gains Tax Plan Smartasset

However it was struck down in.

. Web A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher. Web First deduct the Capital Gains tax-free allowance from your taxable gain.

Web 2 days agoThe 45p rate of tax threshold has been reduced from 150000 to 125140. However if your investments end up losing money rather than generating. Web The proposal would increase the maximum stated capital gain rate from 20 to 25.

Web 2 days agoA cut in the Capital Gains Tax threshold from 12000 to 6000 meanwhile is set to hit those with their cash outside ISAs and pensions tax wrappers who will now pay. Web Mr Hunt also announced that those earning more than 125140 will onw pay the top rate of income tax down from 150000. Assume the Federal capital gains tax rate in 2026 becomes.

Web House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means. Web CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. Web Capital Gains Tax.

Web The proposal would be effective for taxable years beginning after December 31 2021. The Chancellor will announce the next Budget on 3 March 2021. Web If your income grew by 5 2000 in 2023 your 2023 tax income of 42000 would bump you up to the 15 long-term capital gains tax rate if not for the.

Long-term capital gains are taxed at only three rates. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

0 15 and 20. Weve got all the 2021 and. Web Key Points.

Web In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. With average state taxes and a 38. The effective date for this increase would be September 13 2021.

Note that short-term capital gains taxes are even. Web Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Capital gains tax will be cut.

HMRC took a record 61 billion from the tax in 202122 14 per cent more than 202021. Web The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Many speculate that he will increase the.

Web Short-term capital gains are taxed at your ordinary income tax rate. Beyond the deadline for the 2021-22. Web 2 days agoTens of thousands of Britons will pay capital gains tax for the first time after changes announced in the Autumn Statement.

Increase Tax Rate on Capital Gains Current Law. Web Implications for business owners. These are currently 10 at the basic rate and 20 at higher and additional rates although these are 18 and 28 for disposals of residential.

Web But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. By Charlie Bradley 0700.

Mechanics Of The 0 Long Term Capital Gains Rate

How Could Changing Capital Gains Taxes Raise More Revenue

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

2021 2022 Long Term Capital Gains Tax Rates Bankrate

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

September 13 2021 Update Democrats Propose New Tax Increases Srs

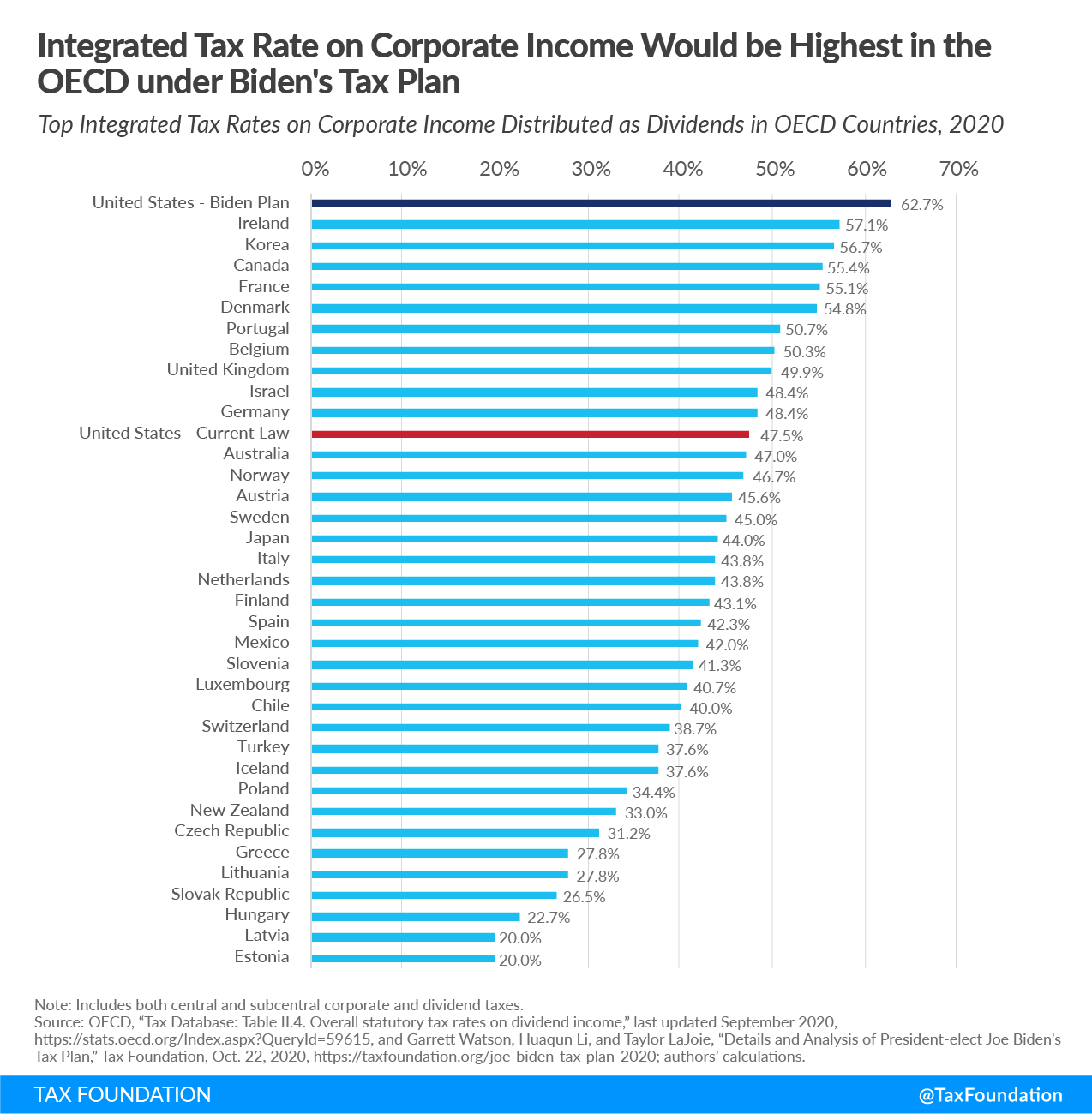

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

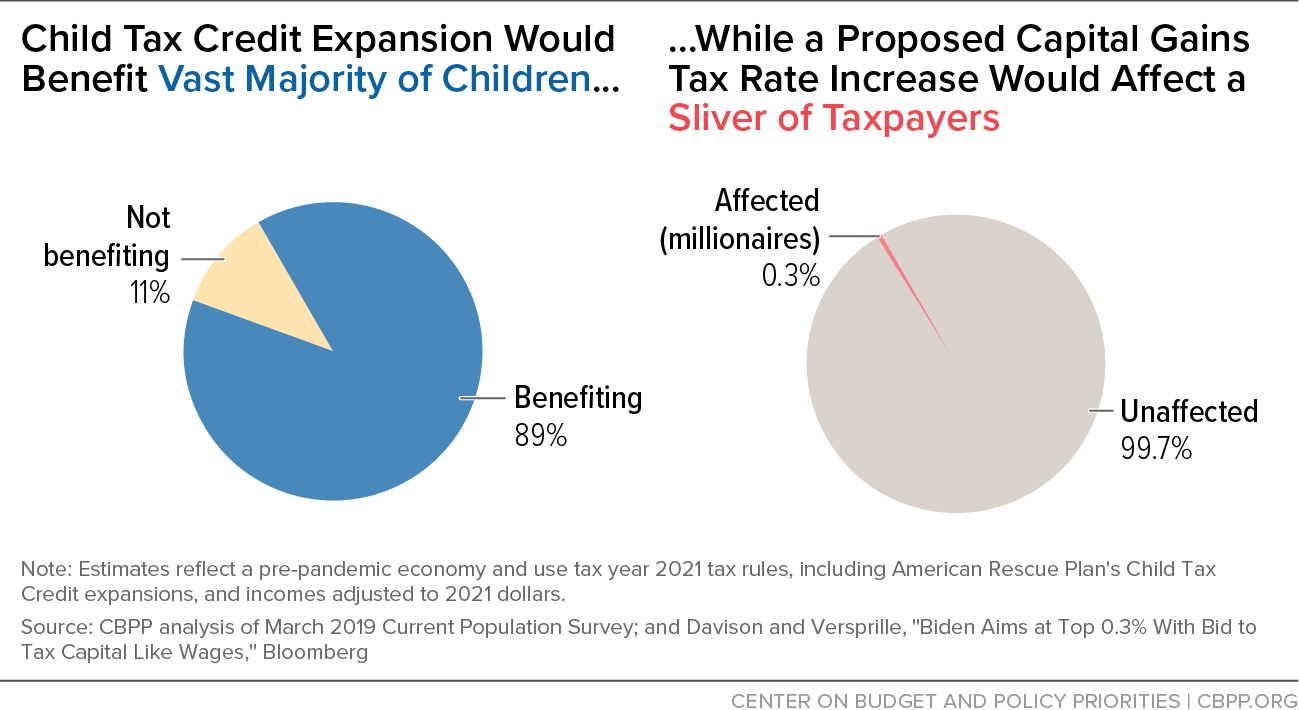

Child Tax Credit Expansion Would Benefit Vast Majority Of Children While A Proposed Capital Gains Tax Rate Increase Would Affect A Sliver Of Taxpayers Center On Budget And Policy Priorities

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

2021 Proposed Tax Law Changes Potential Impacts

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

The Tax Impact Of The Long Term Capital Gains Bump Zone

Why Biden S Plan To Raise Taxes For Rich Investors Isn T Hurting Stocks The New York Times

Tax Foundation On Twitter President Elect Joe Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top